We provide strategies to land and expand your company in Germany.

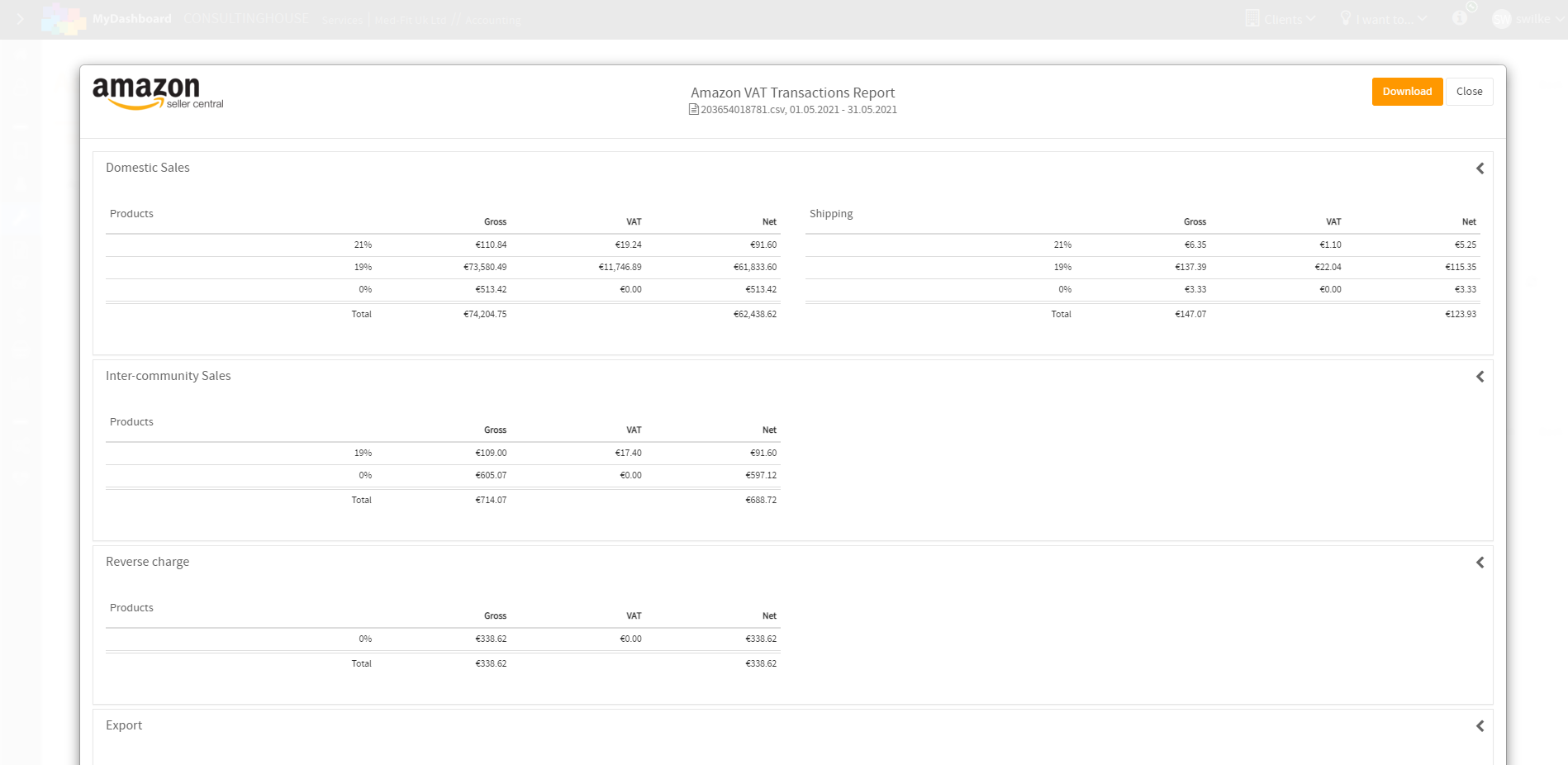

Amazon Connector Overview

The Amazon VAT Transactions Report provides detailed information for

- sales

- returns

- refunds

- cross border inbound

- and cross border fulfillment center transfers

generated through Amazon’s European Websites (amazon.co.uk, amazon.de, amazon.fr, amazon.it, amazon.es), Webstore by Amazon (WBA), and Amazon European Fulfillment Network (FBA and multi-channel fulfillment).

Consultinghouse can help you to quickly understand your Amazon transactions data in order to meet reqired VAT reporting obligations in Germany & greater Europe.

Integration features

We seamlessly process your Amazon VAT transactions report. Find a comprehensive overview of sales transactions by country. Prepare the data for quarterly OSS reporting.

Shared data

| Amazon | Data flow | Consultinghouse |

|---|---|---|

| Amazon VAT Transactions Report |

|

Bookkeeping |

International companies engage our data management services

to sustainably manage their complete business lifecycle in a strong German economy.

Consultinghouse is processing accounting-relevant data. VAT reporting as well as tax & and legal advisory for expanding companies in Germany is provided by our exclusive partner Counselhouse.

Details

Requirements

Pricing plans learn more

Amazon Subscription

Amazon Seller's Central

.png?width=512&height=512&name=union%20(4).png)